URL POINT: https://api.bridgeaccess.life/lender/get_lender_token?id={lender id}

Parameter:

lender id – Lender ID given by access to lender to generate token for accessing api's

RETURN VALUES

URL POINT: https://api.bridgeaccess.life/lender/get_loan_ids?token={token}

Parameter:

Token – generated access token

Statuses included - Pending, Approved, Approved With Terms, Missing Information, Approved with Updated Bank Details

RETURN VALUES

URL POINT: https://api.bridgeaccess.life/loans_profile/loan_profile_details?token={token}&loan_id={loan_id}

Parameters:

Loan Id – Loan Id that corresponds with the loan id on the Access Platform

Token – Access Platform token

RETURN VALUES

URL POINT: https://api.bridgeaccess.life/loans_profile/loan_profile_details

Note :

To check if the approved loan terms and documents are already accepted please refer to the

electronic signature end point

Parameters:

Loan Id – Loan Id that corresponds with the loan id on the Access Platform

Format - (int) | Ex. 4114

Token – Access Platform token

Format - (varchar|encoded) | Ex. "ZXlKMGVYQWlPaUpLVjFRaUxDSmhiR2...."

Loan Amount Approved – Amount approved by the lender

Format - (int) | Ex. 12000

Monthly Deduction – Amount set by the lender that will be deducted monthly

Format - (int) | Ex. 6000

Comment – Lender comment for the application

Format - (varchar) | Ex. "comment here"

Interest – Lender interest rate for the application

Format - (float) | Ex. 0.05

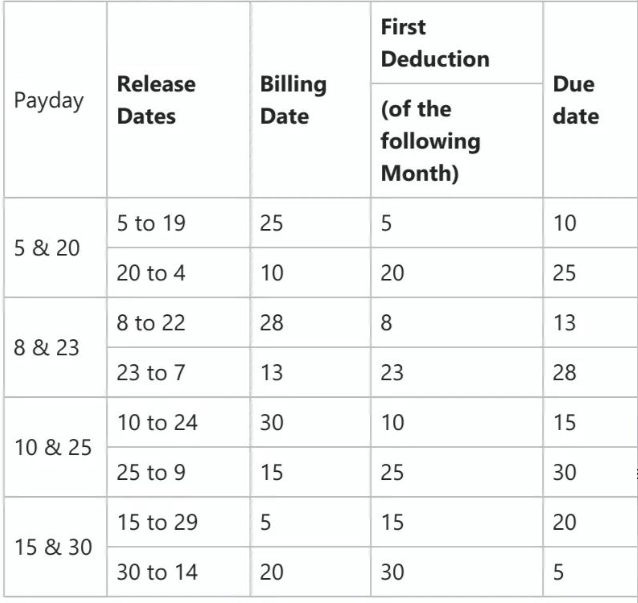

First Due Date – First date of deduction from the Lender (see below Billing and Due Date Schedule)

Format - (date) | Ex. "2020-11-01"

Loan Status – Status update for approve ('approved')

Format - (varchar) | Ex. "approved"

Term – Months on which the loan will be computed

Format - (int) | Ex. 3

Sample POST JSON :

{

"token" : "ZXlKMGVYQWlPaUpLVjFRaUxDSmhiR2....",

"loan_id" : "4514",

"loan_amount_app": "12000",

"monthly_deduct": "6000",

"terms": "12",

"interest": "0.5",

"first_due_date": "2020-11-10",

"loan_status": "approved",

"comment": "approved"

}

RETURN VALUES

URL POINT: https://api.bridgeaccess.life/loans_profile/loan_profile_details

Parameters:

Loan Id – Loan Id that corresponds with the loan id on the Access Platform

Format - (int) | Ex. 4114

Token – Access Platform token

Format - (varchar|encoded) | Ex. "ZXlKMGVYQWlPaUpLVjFRaUxDSmhiR2...."

Comment – Lender comment for what is missing in the application

Format - (varchar) | Ex. "missing information"

Loan Status – Status update for missing information ('missing_information')

Format - (varchar) | Ex. "missing_information"

Missing Fields – Specific tagging of fields

Format - (varchar) | Ex. "Address,Date of Birth"

Options only Detected - Address, Date of Birth, Valid Id, Payslip1, Payslip2, Bank Information, Others

Sample POST JSON :

{

"token" : "ZXlKMGVYQWlPaUpLVjFRaUxDSmhiR2....",

"loan_id" : "4514",

"loan_status": "missing_information",

"comment": "missing_information"

"missing_document_fields": "Address"

}

RETURN VALUES

URL POINT: https://api.bridgeaccess.life/loans_profile/loan_profile_details

Parameters:

Loan Id – Loan Id that corresponds with the loan id on the Access Platform

Format - (int) | Ex. 4114

Token – Access Platform token

Format - (varchar|encoded) | Ex. "ZXlKMGVYQWlPaUpLVjFRaUxDSmhiR2...."

Loan Status – Status update for disapproved ('disapproved')

Format - (varchar) | Ex. "disapproved"

Comment – Lender comment for what is missing in the application

Format - (varchar) | Ex. "disapproved due to incomplete details"

Sample POST JSON :

{

"token" : "ZXlKMGVYQWlPaUpLVjFRaUxDSmhiR2....",

"loan_id" : "4514",

"loan_status": "disapproved",

"comment": "disapproved due to incomplete details"

}

RETURN VALUES

URL POINT: https://api.bridgeaccess.life/loans_profile/loan_profile_details

Parameters:

Loan Id – Loan Id that corresponds with the loan id on the Access Platform

Format - (int) | Ex. 4114

Token – Access Platform token

Format - (varchar|encoded) | Ex. "ZXlKMGVYQWlPaUpLVjFRaUxDSmhiR2...."

Loan Status – Status update for failed disbursement ('failed_disbursement')

Format - (varchar) | Ex. "failed_disbursement"

Comment – Lender comment for what is missing in the application

Format - (varchar) | Ex. "Bank Failed Disbursement"

Sample POST JSON :

{

"token" : "ZXlKMGVYQWlPaUpLVjFRaUxDSmhiR2....",

"loan_id" : "4514",

"loan_status": "failed_disbursement",

"comment": "Bank Failed Disbursement"

}

RETURN VALUES

URL POINT: https://api.bridgeaccess.life/loans_profile/loan_profile_details

Parameters:

Loan Id – Loan Id that corresponds with the loan id on the Access Platform

Format - (int) | Ex. 4514

Token – Access Platform token

Format - (varchar|encoded) | Ex. "ZXlKMGVYQWlPaUpLVjFRaUxDSmhiR2...."

Loan Amount Approved - Loan amount that is funded and approved

Format - (int) | Ex. 12000

Loan Status – Status of application (funded)

Format - (varchar) | Ex. "funded"

Funded Date – date when application was funded

Format - (date) | Ex. 2020-11-01

Receipt String - base 64 encoded receipt proof of funding (image/screenshot - deposit slip, reference number)

Format - (varchar|encoded) | Ex. "data:image/png;base64,iVBORw0KGgoAAAANSUhEUgAA6QAAAARnQU...."

Sample POST JSON :

{

"token" : "ZXlKMGVYQWlPaUpLVjFRaUxDSmhiR2....",

"loan_id" : "4514",

loan_amount_app": "12000",

"date_funded": "2020-11-03",

"loan_status": "funded",

"comment": "approved",

"receipt_string":"data:image/png;base64,iVBORw0KGgoAAAANSUhEUgAAAkIAAAKyCAYAAAA5NbEZAAAAAXNSR0IArs4c....

}

RETURN VALUES

URL POINT: https://api.bridgeaccess.life/lender/lender_documents

Parameters:

Loan Id – Loan Id that corresponds with the loan id on the Access Platform

Token – Access Platform token

RETURN VALUES

URL POINT: https://api.bridgeaccess.life/borrower_documents/borrower_documents?token={token}&loan_id={loan_id}

Parameter:

Loan Id – Loan Id that corresponds with the loan id on the Access Platform

Token – Access Platform token

Success Return Values :

Company Id - Company Id of the borrower

Government Id - TIN, SSS, UMID

Signature - A copy of the borrowers signature

Payslip One - 1st Cutoff of the Payslip

Payslip Two - 2nd Cutoff of the Payslip

Recent Photo

RETURN VALUES

URL POINT: https://api.bridgeaccess.life/lender/lender_documents

Parameter:

Loan Id – Loan Id that corresponds with the loan id on the Access Platform

Format - (int) | Ex. 5414

Promissory Note – base_64 encoded image/pdf

Format - (varchar|encoded) | Ex. "data:image/png;base64,iVBORw0KGgoAAAANSUhEUgAA6QAAAARnQU...."

Disclosure Statement – base_64 encoded image/pdf

Format - (varchar|encoded) | Ex. "data:image/png;base64,iVBORw0KGgoAAAANSUhEUgAA6QAAAARnQU...."

Authority to deduct – base_64 encoded image/pdf

Format - (varchar|encoded) | Ex. "data:image/png;base64,iVBORw0KGgoAAAANSUhEUgAA6QAAAARnQU...."

Amortization Schedule – base_64 encoded image/pdf

Format - (varchar|encoded) | Ex. "data:image/png;base64,iVBORw0KGgoAAAANSUhEUgAA6QAAAARnQU...."

Loan Privacy – base_64 encoded image/pdf

Format - (varchar|encoded) | Ex. "data:image/png;base64,iVBORw0KGgoAAAANSUhEUgAA6QAAAARnQU...."

Sample POST JSON :

{

"token" : "ZXlKMGVYQWlPaUpLVjFRaUxDSmhiR2....",

"loan_id" : "4514",

"promissory_note":"data:image/png;base64,iVBORw0KGgoAAAANSUhEUgAAAkIAAAKyCAYAAAA5NbEZAAAAAXNSR0IArs4c....

"disclosure_statement":"data:image/png;base64,iVBORw0KGgoAAAANSUhEUgAAAkIAAAKyCAYAAAA5NbEZAAAAAXNSR0IArs4c....

"authority_deduct":"data:image/png;base64,iVBORw0KGgoAAAANSUhEUgAAAkIAAAKyCAYAAAA5NbEZAAAAAXNSR0IArs4c....

"amortization_schedule":"data:image/png;base64,iVBORw0KGgoAAAANSUhEUgAAAkIAAAKyCAYAAAA5NbEZAAAAAXNSR0IArs4c....

"loan_privacy":"data:image/png;base64,iVBORw0KGgoAAAANSUhEUgAAAkIAAAKyCAYAAAA5NbEZAAAAAXNSR0IArs4c....

}

Sample Post Request (via CURL):

curl --location --request POST 'bridgeaccess.life/api/access/lender_documents' \

--header 'Cookie: ci_session=v712bsvohi2cdgjj0h5vslj0g2npetla' \

--form 'token=aaaaaaaaa' \

--form 'loan_id=3894' \

--form 'promisorry_note={base_64}' \

--form 'disclosure_statement={base_64}' \

--form 'authority_to_deduct={base_64}' \

--form 'amortization_schedule={base_64}' \

--form 'loan_privacy={base_64}' \

RETURN VALUES

URL POINT: https://api.bridgeaccess.life/loans_profile/loan_repayment_list?token={token}&loan_id={loan_id}

Parameters:

Loan Id – Loan Id that corresponds with the loan id on the Access Platform

Token – Access Platform token

RETURN VALUES

URL POINT: https://api.bridgeaccess.life/lender/bank_list?token={token}

Parameters:

Token – Access Platform token

RETURN VALUES